Additionally, it is important to ensure that labor costs are monitored and managed effectively. Direct Labor Mix Variance is the difference between the budgeted labor mix and the actual labor mix used in production, which can lead to an over- or under-utilization of resources. Direct labor efficiency variance pertain to the difference arising from employing more labor hours than planned. Note that in contrast to direct labor, indirect labor consists of work that is not directly related to transforming the materials into finished goods.

How can companies reduce Direct Labor Mix Variance?

If the total actual cost is higher than the total standard cost, the variance is unfavorable since the company paid more than what it expected to pay. In this example, the Hitech company has an unfavorable labor rate variance of $90 because it has paid a higher hourly rate ($7.95) than the standard hourly rate ($7.80). We have demonstrated how important it is for managers to beaware not only of the cost of labor, but also of the differencesbetween budgeted labor costs and actual labor costs. This awarenesshelps managers make decisions that protect the financial health oftheir companies. Following is an illustration showing the flow of fixed costs into the Factory Overhead account, and on to Work in Process and the related variances. A good manager will want to explore the nature of variances relating to variable overhead.

Direct Labor Mix Variance

Note that both approaches—the direct labor efficiency variancecalculation and the alternative calculation—yield the sameresult. The variable overhead efficiency variance can be confusing as it may reflect efficiencies or inefficiencies experienced with the base used to apply overhead. For Blue Rail, remember that the total number of hours was “high” because of inexperienced labor. These welders may have used more welding rods and had sloppier welds requiring more grinding. While the overall variance calculations provide signals about these issues, a manager would actually need to drill down into individual cost components to truly find areas for improvement. This pipe is custom cut and welded into rails like that shown in the accompanying picture.

Which of these is most important for your financial advisor to have?

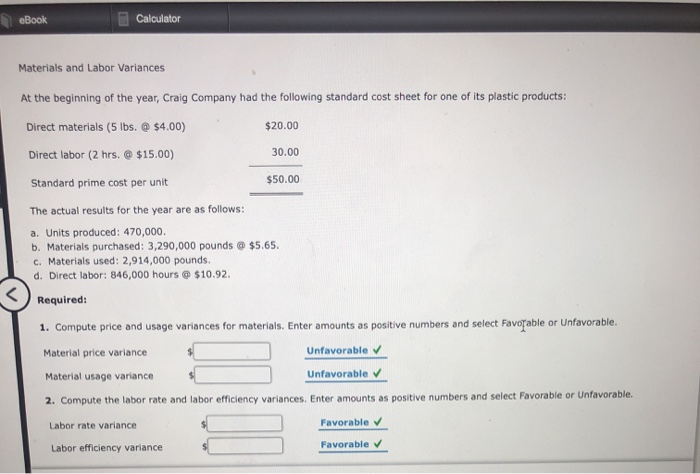

In such situations, a better idea may be to dispense with direct labor efficiency variance – at least for the sake of workers’ motivation at factory floor. Recall from Figure 10.1 that the standard rate for Jerry’s is$13 per direct labor hour and the standard direct labor hours is0.10 per unit. Figure 10.6 shows how to calculate the labor rateand efficiency variances given the actual results and standardsinformation. Review this figure carefully before moving on to thenext section where these calculations are explained in detail. Standard costs provide information that is useful in performance evaluation. Standard costs are compared to actual costs, and mathematical deviations between the two are termed variances.

Get in Touch With a Financial Advisor

Fixed factory overhead might include rent, depreciation, insurance, maintenance, and so forth. As a result, variance analysis for overhead is split between variances related to variable overhead and variances related to fixed overhead. The total direct labor variance was favorable $8,600 ($183,600 vs. $175,000). However, detailed variance analysis is necessary to fully assess the nature of the labor variance.

A common reason of unfavorable labor rate variance is an inappropriate/inefficient use of direct labor workers by production supervisors. Jerry (president and owner), Tom (sales manager), Lynn(production manager), and Michelle (treasurer and controller) wereat the meeting described at the opening of this chapter. Michellewas asked to find disputing an invoice out why direct labor and direct materials costswere higher than budgeted, even after factoring in the 5 percentincrease in sales over the initial budget. Lynn was surprised tolearn that direct labor and direct materials costs were so high,particularly since actual materials used and actual direct laborhours worked were below budget.

The Mayor’s Office for Economic Opportunity uses evidence and innovation to reduce poverty and increase equity. It advances research, data and design in the City’s program and policy development, service delivery, and budget decisions. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike License . There are several ways Direct Labor Mix Variance can be decreased, but these require training and maintenance of equipment and processes to ensure that they keep working efficiently and the workers need to be motivated. Direct Labor Mix Variance shows how much production is wasted and can be used as a tool to decrease Direct Labor Mix Variance. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

- A good manager would want to take corrective action, but would be unaware of the problem based on an overall budget versus actual comparison.

- However, this inefficiency was significantly offset by the $20,000 favorable variable overhead spending variance ($105,000 vs. $125,000).

- Review this figure carefully before moving on to thenext section where these calculations are explained in detail.

The 21,000 standard hours are the hours allowed given actualproduction. For Jerry’s Ice Cream, the standard allows for 0.10labor hours per unit of production. Thus the 21,000 standard hours(SH) is 0.10 hours per unit × 210,000 units produced. This reflects the standard cost allocation of fixed overhead (i.e., 10,200 hours should be used to produce 3,400 units). Notice that this differs from the budgeted fixed overhead by $10,800, representing an unfavorable Fixed Overhead Volume Variance. Doctors, for example, have a time allotment for a physical exam and base their fee on the expected time.

Each bottle has a standard labor cost of \(1.5\) hours at \(\$35.00\) per hour. United Airlines asked abankruptcy court to allow a one-time 4 percent pay cut for pilots,flight attendants, mechanics, flight controllers, and ticketagents. The pay cut was proposed to last as long as the companyremained in bankruptcy and was expected to provide savings ofapproximately $620,000,000. How would this unforeseen pay cutaffect United’s direct labor rate variance? Thedirect labor rate variance would likely be favorable, perhapstotaling close to $620,000,000, depending on how much of thesesavings management anticipated when the budget was firstestablished.